Fascination About Pacific Prime

Fascination About Pacific Prime

Blog Article

The 5-Minute Rule for Pacific Prime

Table of ContentsHow Pacific Prime can Save You Time, Stress, and Money.Pacific Prime for DummiesAn Unbiased View of Pacific PrimeGetting My Pacific Prime To WorkThe Facts About Pacific Prime Uncovered

Insurance coverage is an agreement, stood for by a plan, in which an insurance policy holder gets economic security or reimbursement versus losses from an insurance provider. The business swimming pools clients' dangers to pay a lot more cost effective for the insured. Many people have some insurance coverage: for their vehicle, their residence, their health care, or their life.Insurance policy likewise helps cover costs connected with liability (lawful responsibility) for damage or injury triggered to a third party. Insurance coverage is a contract (policy) in which an insurer compensates another versus losses from particular backups or perils.

Investopedia/ Daniel Fishel Several insurance plan types are offered, and essentially any type of individual or service can discover an insurance coverage company ready to guarantee themfor a cost. Many people in the United States have at the very least one of these types of insurance coverage, and vehicle insurance policy is required by state regulation.

An Unbiased View of Pacific Prime

So finding the price that is ideal for you needs some research. The policy limitation is the maximum amount an insurance provider will pay for a covered loss under a plan. Maximums might be established per duration (e.g., yearly or plan term), per loss or injury, or over the life of the policy, likewise called the lifetime optimum.

There are many different types of insurance policy. Health insurance coverage assists covers regular and emergency clinical treatment prices, frequently with the option to include vision and oral solutions separately.

Many preventative services might be covered for totally free prior to these are satisfied. Health insurance coverage might be bought from an insurance company, an insurance coverage agent, the federal Wellness Insurance policy Market, given by an employer, or federal Medicare and Medicaid coverage. The federal government no much longer requires Americans to have wellness insurance coverage, however in some states, such as The golden state, you might pay a tax obligation penalty if you don't have insurance coverage.

The 30-Second Trick For Pacific Prime

The firm then pays all or most of the protected prices connected with an auto accident or various other car damage. If you have a rented automobile or obtained cash to get an auto, your lending institution or leasing dealer will likely need you to carry car insurance.

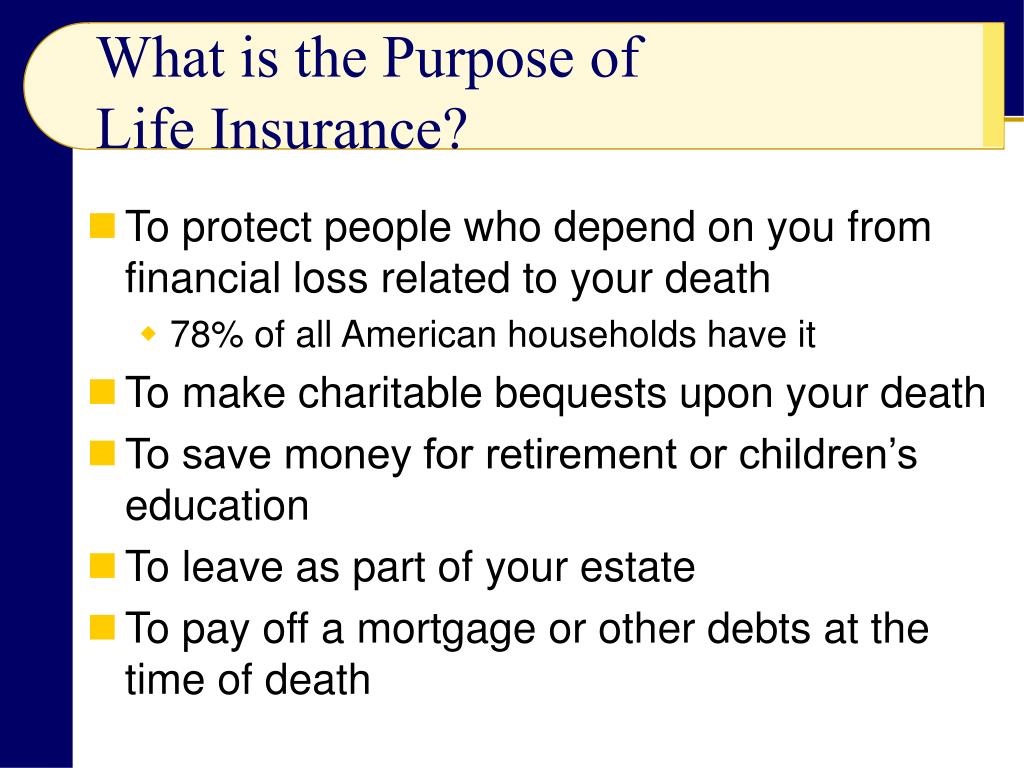

A life insurance policy plan guarantees that the insurance provider pays a sum of money to your recipients (such as a partner or youngsters) if you die. In exchange, you pay premiums during your lifetime. There are two main kinds of life insurance policy. Term life insurance coverage covers you for a specific period, such as 10 to two decades.

Irreversible life insurance policy covers your entire life as long as you continue paying the premiums. Traveling insurance policy covers the expenses and losses connected with taking a trip, including trip terminations or delays, coverage for emergency health and wellness treatment, injuries and discharges, harmed baggage, rental autos, and rental homes. Also some of the ideal travel insurance policy firms do look at this site not cover cancellations or delays because of weather, terrorism, or a pandemic. Insurance is a method to handle your financial dangers. When you get insurance policy, you purchase protection versus unanticipated monetary losses. The insurance policy business pays you or someone you pick if something poor happens. If you have no insurance coverage and a crash takes place, you may be accountable for all associated costs.

Getting The Pacific Prime To Work

Although there are several insurance coverage policy kinds, a few of the most common are life, wellness, homeowners, and auto. The appropriate kind of insurance for you will certainly rely on your objectives and financial circumstance.

Have you ever had a minute while looking at your insurance coverage or searching for insurance coverage when you've thought, "What is insurance coverage? And do I actually need it?" You're not the only one. Insurance can be a strange and puzzling thing. Just how does insurance coverage work? What are the advantages of insurance policy? And how do you discover the best insurance coverage for you? These are usual concerns, and the good news is, there are some easy-to-understand answers for them.

Nobody desires something negative to take place to them. Suffering a loss without insurance can put you in a challenging economic situation. Insurance is an essential financial tool. It can assist you live life with fewer fears understanding you'll receive monetary help after a disaster or crash, assisting you recoup much faster.

Pacific Prime for Dummies

And in some instances, like automobile insurance coverage and employees' compensation, you might be required by law to have insurance policy in order to secure others - international travel insurance. Learn more about ourInsurance options Insurance is essentially a gigantic rainy day fund shared by lots of individuals (called insurance policy holders) and taken care of by an insurance coverage service provider. The insurance provider utilizes cash gathered (called costs) from its insurance holders and other financial investments to spend for its operations and to fulfill its guarantee to insurance policy holders when they sue

Report this page